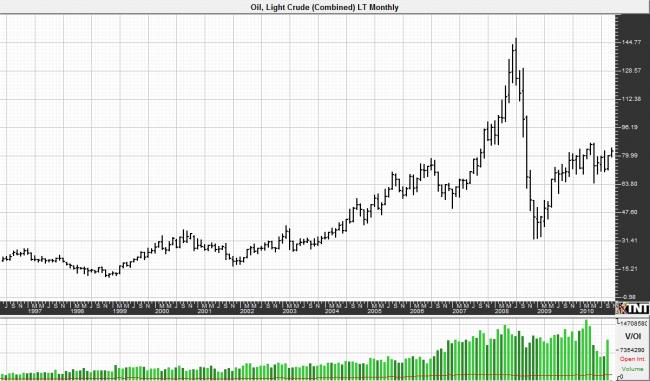

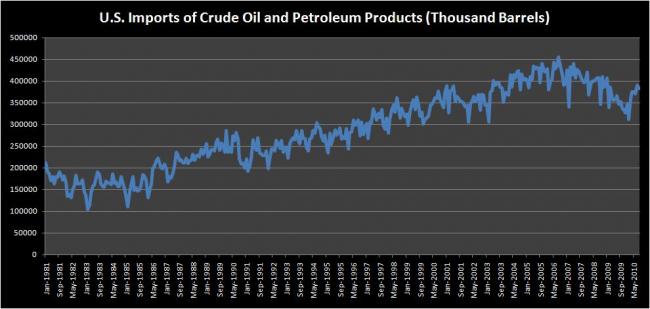

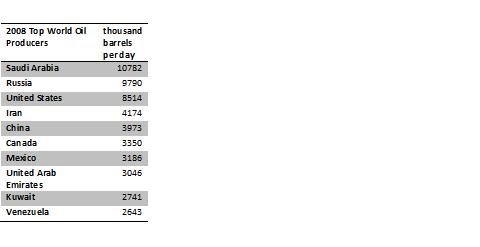

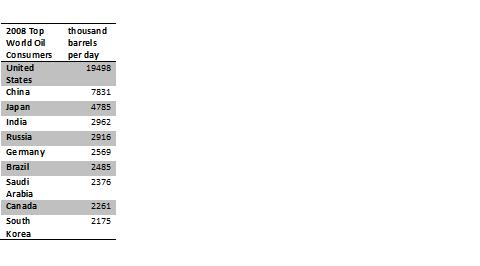

| The Learn About Futures Insider: Crude Oil Sometimes mythic, often controversial, crude oil has been an important component of modern times. Crude oil comes in many colors and consistencies, from hydrocarbon rich reservoirs in Texas to the heavy oil sands of Canada and Venezuela. Usually named for their region of production as well as other factors, crude oil properties can include various elements including carbon, nitrogen, oxygen, sulfur, and metals. Due to international appeal and demand, there are different tradable crude oil contracts across the globe, but for the purposes of this report, specifications willl focus on the NYMEX Light, Sweet crude oil contract. Contract Size:1,000 US barrels or 42,000 gallons Price Quote & Tick Size:Dollars and cents per barrel; minimum tick size is one cent per barrel or $10.00 per contract Contract Months: All months Trading Specs: Open outcry on NYMEX runs from 9:00 am to 2:30 pm ET. Electronic trading on Globex runs Sunday through Friday 6:00 pm until 5:15 pm with a 45 minute break each day. Daily Price Limit: $10.00 per barrel or $10,000 per contract. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $10.00 per barrel in either direction. If another halt were triggered, the market would continue to be expanded by $10.00 per barrel in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session. Trading Symbols: CL  ***chart courtesy of Gecko Software Crude Oil Facts Crude oil is not limited to modern uses as history shows examples of petroleum products being applied for nearly four thousand years. However, there is no doubt that the volume of consumption and the variety of applications for crude oil exploded in the middle of the nineteenth century. First driven by the demand for kerosene and oil lamps, the introduction of the internal combustion engine sealed crude oil's fate and ushered in the era of oil booms across the United States. As oil quickly overtook coal as the world's leading fuel, it was only a matter of time before reservoirs began to be outpaced by demand and the first "energy crisis" hit in the 1970's. In the 1980's, increased production and lower demand led to an "oil glut". US imports in the last three decades are illustrated as follows:  Past performance is not indicative of future results. **Data Courtesy of EIA The most well known deposits of petroleum are porous rock formations in which the hydrocarbons that make up the oil are sealed within the rock by an impermeable rock above. These reservoirs are accessed by drilling and pumping. Unconventional oil deposits of heavy crude oil exist in oil sands or oil shales which contain migrating oil or trapped hydrocarbons. Heavier crude oil deposits are often more expensive or require a more intensive process to extract the oil. Most geologists attribute the formation of oil to the compression and heating of organic materials over extremely long periods of geologic time. However, there is an alternate theory that suggests natural petroleum was formed from deposits which may date to the formation of the earth rather than biological origins. World crude oil supply and demand stats are highlighted in the following:  Past performance is not indicative of future results. **Data Courtesy of EIA  Past performance is not indicative of future results. **Data Courtesy of EIA  Past performance is not indicative of future results. **Data Courtesy of EIA  Past performance is not indicative of future results. **Data Courtesy of EIA Key Terms Crack Spread - Based on the word cracking which is the word for breaking down crude oil into products at a refinery. A crack spread is a term used when referring to the price difference between crude oil and extracted products like gasoline or heating oil. Key UsesLight, sweet or sour crude oil - Oil comes in various colors and viscosities. Light, sweet crude oil has less sulfur and is lighter than sour crude oil. Light, sweet crude oil is usually in higher demand for refining into gasoline, kerosene and diesel. Oil sands or tar sands - are semi-solids of crude oil, sand, and water. Usually sticky, sands need to be extracted in unconventional ways since they do not flow like those deposits used with well methods. Big deposits include Athabasca oil sands in Canada and Orinoco oil sands in Venezuela. Crude oil is normally taken to refineries for the hydrocarbon chemicals to be distilled into the common products consumers are all familiar with or to be mixed with chemicals to create other products including: Diesel fuel Gasoline Jet Fuel Kerosene Natural Gas Lubricants Tar Paraffin Key Concerns Hubbert Peak Theory - A geologist working for Shell Oil in the middle part of the last century is widely recognized as the first person to predict an oil peak. M. King Hubbert noted that oil discoveries tended over time to form a bell shaped curve. He suggested that oil production over time would follow a similar path with production in the lower 48 states peaking between 1965 and 1970. Hubbert went on to predict global oil production would peak in the last five years of the 20th century. Using his predictive curve, it appears as though 54 of the largest oil producing nations have already passed their peak of production and are in decline. However, controversy surrounds the theory since many regions lack transparency in accounting for oil reserves. Conclusions vary from intimating that the global peak has already passed to the optimistic notion that the peak will come in 2035. Fossil fuels are defined as finite and since supply can be a major factor when considering pricing - if not the most important - the implications of the theory are boundless. OPEC - The Organization of Petroleum Exporting Countries (OPEC) is a group of thirteen oil producing nations: Algeria, Angola, Ecuador, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela. Created in 1960 and with current headquarters in Vienna, the stated objective of OPEC is to coordinate and unify member petroleum policies to secure fair and stable prices. Actions, statements, and policy changes from member nations can have an immediate impact on the price of oil and meetings are usually foreshadowed by media and trader speculation. Geopolitical Tensions - Disputes and conflicts in any producing nation will naturally have an effect on oil prices . The Gulf War and the War on Terror are probable examples as they centered on top producing regions of the world. Smaller - though no less grave - incursions in or around oil pipes, oil pumps, and oil refineries in areas of Asia and Africa can also affect production, distribution, and price. Alternative Fuels/Environmental Concerns - Controversy surrounds petroleum products and is rooted in the potential harmful effects to the environment and atmosphere. The late 20th and early 21st centuries have focused on producing alternative fuels and engines. They have also seen significant environmental issues ranging from oil spills to the impact of drilling in preserved areas. Alternately and perhaps ironically the effect of the environment on oil production is a key area for concern especially during the Gulf hurricane season when offshore platforms become natural targets and production is pared back or halted completely. The same effect can be felt during winter storms in the North Sea. |

| _______________________________________________________________________________________ Disclaimer: There is a substantial risk of loss in futures trading and it is not suitable for all investors. Losses can exceed your account size and/or margin requirements. Commodities trading can be extremely risky and is not for everyone. Some trading strategies have unlimited risk. Educate yourself on the risks and rewards of such investing prior to trading. Futures Press Inc., the publisher, and/or its affiliates, staff or anyone associated with Futures Press, Inc. or www.learnaboutfutures.com, do not guarantee profits or pre-determined loss points, and are not held monetarily responsible for the trading losses of others (subscribers or otherwise). Past results are by no means indicative of potential future returns. Fundamental factors, seasonal and weather trends, and current events may have already been factored into the markets. Options DO NOT necessarily move lock step with the underlying futures contract. Information provided is compiled by sources believed to be reliable. Futures Press, Inc., and/or its principals, assume no responsibility for any errors or omissions as the information may not be complete or events may have been cancelled or rescheduled. Any copy, reprint, broadcast or distribution of this report of any kind is prohibited without the expressed written consent of Futures Press, Inc. |

Thursday, October 28, 2010

The Learn About Futures Insider for Oct 28th, 2010: Crude Oil

Wednesday, October 27, 2010

The Bullion Report for Oct 27th: At Ease

Past performance is not indicative of future results.

***chart courtesy Gecko Software’s Track n’ Trade Pro

Easing is a banking tool that is meant to stimulate economic activity. The Federal Reserve would aim to do this with a round of Treasury purchases. This would keep them on their current course of reducing interest rates and trying to jumpstart the money supply. With these purchases, they get excess reserves to make new money. The effect can be what the name implies – it gives the banks and the economy some breathing room.

The risks to easing run the gamut between the potential for hyperinflation and the chance that the easing will not be long or deep enough to achieve the desired stimulus results. In the present environment, both situations would likely represent a bane to the Federal Reserve and a boon to gold and other precious metals.

Debasing the U.S. dollar by increasing the money supply would likely spur additional interest in gold and other precious metal investment. After all, inflation serves to devalue a regular savings account. The trick to this, and the hope of the Federal Reserve officials who support this course of action, is that the global stage will negate the effect of this round of easing. Basically, if all the other central banks are doing it, there will be no one single losing currency. This kind of “competitive devaluation” might temper the reaction from the market. The caveat is that the increase in money supply on a global level would still be a possible motivator for investors who jump on gold as an inflation hedge.

Even if the inflation-situation does not come into play, or it is successfully combated, there is still an overwhelming amount of debt created by round after round of stimulus aimed at spurring economic activity. This has increased the demand for certain investments – like gold – amid flimsy fundamentals for other financial assets. It will probably mean more business for precious metals as investors seek havens if the stimulus fails and this second round of easing isn’t enough to bolster employment and economic growth.

It will be interesting to see what the Federal Reserve commits to, following next week’s meeting. Guesses seem to be centered on the possible commitment from officials to buy up $100 billion in Treasury debt per month for the next five months. This headline may already be priced into the markets, but recent gains in the dollar set up an interesting situation. The drop in gold prices on the strengthening U.S. currency could have set up perceived value entry points ahead of any additional official announcements. According to a story from Reuters, gold traders in India were already scooping up the metal on lower prices amid their festival and wedding season peaks. (1)

It seems unlikely that the Federal Reserve will fall short of the market expectations. Doing so at this point would bump up the dollar but it would jolt other financial markets in the process. Officials have not been working this hard for this long to rock the boat, despite some member objections to another round of stimulus. To quote Ben Bernanke’s own speech from the beginning of 2009, “The global economy will recover, but the timing and strength of the recovery are highly uncertain.” With this in mind, the effort they could be announcing next week will probably fall in line with their actions thus far. Commit to maintaining a response that adds liquidity and stimulus but keep the door open. This means giving a nudge and a wink but not committing to huge purchases right away. Look for officials to nibble at easing, not gobble.

Summary

There is probably no quick fix to housing and employment issues, but there has been strong effort to repair things since the 2007 start of the crisis. The cumulative efforts of the Federal Reserve could see results at some point, after all, employment is seen as a lagging indicator of the health of an economy. However, until there is a solid compass point that shows tangible recovery and economic strength, fear will still prevail. Fear of economic troubles and fear of future inflation issues as a direct result of continuing stimulus. This means that there is still a proverbial basket of issues from which investors can pull a potential catalyst for higher gold prices.

For your FREE gold trading kit, call (866)258-5997.

As we move towards 8 or 10 billion people on the planet, there's a little less gold per capita. Each one of us will continue to be fighting over an ever smaller percentage of total resources. This is not a happy thought. - Dean Kamen

1 http://economictimes.indiatimes.com/...ow/6821101.cms

To register to receive this report FREE via email, please visit http://newsletter.berkshireassetmgt.com

Monday, October 25, 2010

PitGuru.com Weekly Grains Review for Oct 25th

By Matthew Pierce

Friday saw a choppy lower session with both corn and beans following the script gravitating back to the highest open interest strikes at $5.60 and $12.00. This kept most of the trade subdued throughout the session with nothing exciting on the fundamental side to direct interest ahead of the weekend. There was little expected so the trade allowed options to dictate the pace. Over the weekend I saw 4364 of the SX 12.00 calls exercised with 226 puts abandoned…a good move in hindsight. In corn I saw 3016 calls exercised and 5568 puts. The puts were thought to have futures against them. These were the only two features with all other floor commodities showing only marginal interest in Nov. The overnight session was dictated by macro factors with the USD taking another dive following nothing coming out of the G20 meeting. Crude is up on extreme food oil demand with palm screaming higher making 2 year highs. Chinese markets were higher as well helping the corrective upside sentiment. The day session looks to open in line or stronger than the overnight with support from the Euro, Chinese demand, Aussie weather and now talk of standing water delaying plantings in the SW of the US HRW region.

Today’s calls are as follows: Beans are called 15-20 Higher looking at the contract high at 1235 (SF) as the first bull target. Corn is called 10-12 Higher looking to go above Friday’s high with last week’s high at 579 ½ the first upside target with the contract high at 588 offering a second level this week. Indicators remain in the upper end of the range but are still below the contract highs. Wheat is called 7-10 Higher looking to achieve the 50-day MA sitting at 702 ½ this week. Meal is called 2-3 dollars Higher looking at last week’s contract high at 340.20 as the only target. Bean oil is called 130-150 Higher leading the way on the floor looking to achieve the 50% weekly retracement level at 49.77.

Concerning weather: Weekend rains were far greater than expected in the SW region of the US with many areas that needed rains receiving them for HRW plantings. This system moved slowly across the Midwest with all harvest activity stalled. This should ease the record rate seen for this year’s harvest allowing time to catch up with the markets. There is some talk of too much rain in areas of N. TX, NE OK and SE KS but this is not a major factor yet. The benefit of the overall rains outweighs the spotty standing water. The above map shows a bearish forecast with only the far NE corner of the Corn Belt still looking at any rains to stall harvest. Looking at Australian weather, the NW’s opportunity for rain is stunted today as compared with Friday’s forecast. The forecasted rains have been pushed off to this weekend with fading confidence in the overall impact this will have. Without these rains Aussie NW production will fall to less than 50% of last year’s crop. China is looking at a very cold forecast possibly damaging their recently planted winter grain crops with wheat a serious concern. This is a short lived situation but one that deserves watching due to wheat corn relationship spread levels.

Looking ahead at this week I see commodity demand as the major factor. Chinese demand in particular is the focal point of the trade with continued rumors floating all over the trade that a major corn deal is in the works. This only enhances the availability of profit in long option and volatility plays heading into Month End. I expect to see more and more OI hitting the trade as moving into Nov due to profit potential versus a staggering US equity picture. The retail sector looks to suffer even though estimates are above last year. The 5-year trend remains low and slow not offering any incentive to join the party. On the other hand, commodities continue to gain in open interest; commodities have a real supply and demand story coupled with massive world currency issues. This train is just warming up for all late comers.

***chart courtesy Gecko Software’s Track n’ Trade Pro

Past performance is not necessarily indicative of future results.

Pitguru Financials Review for oct 18, 2010

By PitGuru Frank LaMantia

Citigroup earned $2.15 billion compared to a loss of $3.24 billion last year at this time. It is still owned by the government but shares are being sold back slowly. Currently the government owns about 12% of the company and wants to be free of the company by year end 2011. Bad loans are down 30% for the past quarter to $7.66 billion which could mean consumers may be getting control of personal finances. (1)This trader mentioned that buyout and mergers may jump this quarter. Not every company is struggling and when one company falls another takes its place. Survival of the fittest has been how Wall Street worked over the past 100 years. But since 2007 government aid, bailouts, and the too big to fail attitude has changed this motto. Northeast Utilities is purchasing New England Energy for $4 billion in stock and St Jude Medical is buying AGA Medical Holdings for $20.80 per share. The company is also taking over $220 million of debt but is taking over a rival company. (2) (3)

Industrial production was announced down -0.2% and was forecasted to be up 0.1%. Capacity Utilization came in as expected at 74.7%. Tuesday housing starts and building permits are both forecast to come in at 550k. On Wednesday Mortgage Applications which came in at 14.6% at the last announcement will be released; along with Crude Inventories. Many will be looking at Thursday’s initial jobless claims which are forecast to be 450k. Also leading indicators will be released and expected to be around 0.3%. (4)

Apple will be announcing earnings after the close which could propel the market overnight. IBM is also a name that one should be watching to see if the markets will take kindly to the numbers. This week earnings and language used by the Fed could give a more clear direction on where this market is headed. Obviously, the market is stagnant at technical levels previously discussed.

1 http://finance.yahoo.com/news/Citigroup-earns-215-billion-apf-1301075638.html?x=0&sec=topStories&pos=main&asset=&ccode=

2 http://www.cnbc.com/id/39718420

3 http://www.cnbc.com/id/39719414

4 http://biz.yahoo.com/c/e.html

***chart courtesy Gecko Software’s Track n’ Trade Pro

Past performance is not necessarily indicative of future results.