Today the markets eagerly anticipate an announcement from the Federal Reserve as it wraps up a two day meeting. The focus will fall on the full measure of proposed quantitative easing. Heading into the report, there has been little doubt that the Fed will take some easing measures and that the US dollar and

metals markets will react. So far this year, gold and silver have made fresh highs, reigniting interest into the high marks of the past and the events that motivated them.

Past performance is not indicative of future results.

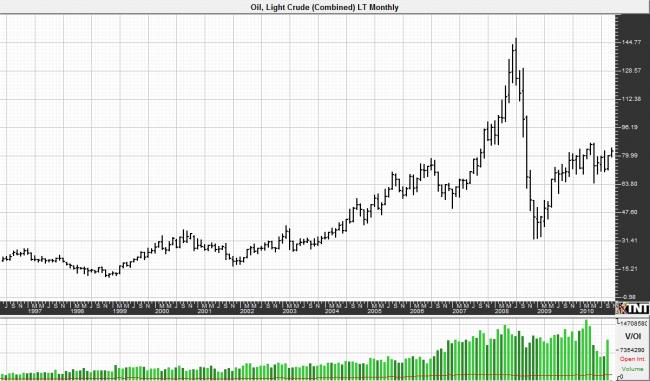

***chart courtesy Gecko Software’s Track n’ Trade Pro

Past performance is not indicative of future results.

***chart courtesy Gecko Software’s Track n’ Trade Pro

The fundamental focus for the last few years has been relatively narrow, falling on a handful of US dollar events and a broad picture of the global economic landscape. The housing and credit crisis precipitated reactions from the Federal Reserve that led to easing and a drop in the US dollar. Subsequent economic fallout including high unemployment and stagnant growth led some investors to the ‘haven’ of precious metals as an alternative asset. This has continued to bring some high price levels in both gold and silver.

The march to new highs in gold was nearly three decades in the making. In 1980, the price of gold topped $850 amid a climate of high inflation, high

oil prices, and high geo-political tensions, specifically in Afghanistan. The price of gold tumbled following that peak, apparently bottoming out above $250 an ounce in 1999. The low came in as investors speculated that central banks would begin selling their gold reserves. Once the central banks of Europe signed their gold agreement limiting gold sales, the stage was set for a price comeback.

Past performance is not indicative of future results.

***chart courtesy Gecko Software’s Track n’ Trade Pro

In the decade that followed, gold prices picked up steam, gathering momentum as geopolitical tensions began to rise and commodities prices picked up. Starting in 2006, the weakening dollar provided a likely catalyst for investors to move towards commodities. The subsequent price peaks in gold hit a climax in January of 2008 when gold broke that $850 price high. Each new high shook out some investors as profit taking ensued, but the market forged ahead to the $1,000 an ounce level, breaking through in March of that same year. After that, gold prices appeared to fall victim to the commodities exodus as investors began to focus on demand fundamentals and the potential for recovery. Plenty of stimulus was being poured into the global economy in an effort to restart the growth engines, and it appeared to have the potential to work.

However, gold came back after falling below the $700 level. Investment interest and demand, especially in ETFs, grew exponentially last year. That kind of hunger for the perceived haven of gold propelled the market back over the $1,000 mark and beyond. For now, gold has already managed to top $1,380, and there appears no shortage of analysts who thing the twin threats of inflation and fear could move things higher.

Gold prices have not stood alone in hitting fresh highs. Silver has also managed to break out, topping previous high marks. However, cresting the all-time peak in silver prices could be a little more challenging. The peak price in silver took place in the 1980s under the price manipulation of the Hunt Brothers. At that time, silver prices could have been faring reasonably well in tandem with gold as fundamentals like inflation and political tensions affected commodities priced in US dollars. However, the exponentially high silver spike above $50 had some help from the Hunt’s cornering the market. Once the chase had ended, the Hunts were bankrupt and many speculators suffered huge losses.

Finding a high mark in silver prices absent of manipulation, it would seem natural to take a look at the prices in 2008, when gold and other commodities were logging price peaks. In March of that year, silver prices topped $20 an ounce. This level was only recently breached again. Unfortunately, this new high comes as more accusations of manipulation come into play. CFTC commissioner Bart Chilton recently issued a statement that suggests they are looking into the potential that there were attempts to influence silver prices. (1)

Past performance is not indicative of future results.

***chart courtesy Gecko Software’s Track n’ Trade Pro

SummaryThere seems to be little doubt that the recent economic crisis and the reaction to the same have helped propel precious metal prices higher. Gold, as well as silver, have been the beneficiaries of renewed interest from investors. As a result, prices gained a great deal of momentum and hit fresh highs. Going forward, it seems that there is plenty of room for price action on both sides of these high marks. On one hand, the new peaks are likely to inspire intermittent profit taking. On the other hand, the bigger picture could spell strength and support for these markets. What it comes down to is the strength of the fundamentals behind the move. Price highs based solely on fear and manipulation face a greater challenge in finding support on the way down. Those are weaker fundamentals. Gold and silver prices would need to find strength in the possibility that investor and central bank demand for gold will remain vibrant and that the US dollar will remain in a pattern of competitive devaluation.

For your FREE gold trading kit, call (866)258-5997.1

http://www.bloomberg.com/news/2010-10-26/silver-market-faced-fraudulent-efforts-to-control-price-chilton-says.htmlGold and silver are no doubt subject to fluctuations, from the discovery of new and more abundant mines; but such discoveries are rare, and their effects, though powerful, are limited to periods of comparatively short duration. - David Ricardo