Monday, July 6, 2009

Thursday, July 2, 2009

Market Expert: US Recession WILL End First

Monday, June 1, 2009

Stock Option

Successful traders learn to follow a set of rules consistently. These set of rules are called a trading system. When using stock options, it is very important to use a stock option trading system.

I've backtesting several stock option trading systems and have learned to avoid commonly taught systems that result in a net loss over time. A new stock option trading system I am still backtesting involves high flying stocks Google, CME, or RTP.

The leverage of stock options can cut both ways. You can lose faster as well as win faster with stock options. Therefore, you want to get past the point of trading because of emotions or addiction and trade by your rules. Of course, your stock option trading system needs to be backtested with lots of samples to ensure you have positive expectancy.

Positive expectancy means that when you trade many times over the long run, you will have a net profit. You will be surprised that some stock option trading systems being taught or sold may have a NEGATIVE expectancy in the long run. That is, you will be trading at a net loss. They may have worked in a strong trending market a few years ago but they do not work in our current 2005-2006 slightly trending stock market.

That's why I am focusing on stocks that are expensive and that have a high intra-day range - or average true range. Google, CME, and RTP are in the $200 to $500 range. In fact, there are not many other stocks over $200 that have options besides those three. Normally, options two strikes out of the money are relatively expensive for these stocks - except during the expiration week.

Let's look at a stock option trading system I'm still backtesting:

- On the Monday before option expiration, buy three strangles on Google, CME, or RTP that are 2 strikes out of the money for that expiration. For example, on Monday, May 15th, with expiration Friday on May 19th, Google is at 400. Buy the 420 call and the 380 put. If it is not earnings month, the strangle should cost around $300 to $350.

- You'll have to watch the price quote most of the day for Tuesday, Wednesday, Thursday, and even Friday.

- Try to estimate based on chart patterns whether a certain time is close to the high or low for the day. Better than that, if the price of the total strangle is profitable by $100 or more per strangle, sell one. The normal intra-day range for these three stocks swings enough to cause some profit.

- Repeat step 3 on Wednesday and Thursday. Many times a year, there is a news event that can cause a $10 to $30 move on a single day. These are the home runs you are looking for that will more than cancel the strike outs of the relatively inactive days.

This stock option trading system has precise definitions for entry and relatively precise definitions for exit. Trade like a robot one week a month. I've traded this system a few times and have gained more than 50% twice and lost 50% once. In future articles I will present the detailed backtesting results of this system.

Steve BurkeSunday, May 24, 2009

Forex and Foreign Exchange - Trading with Strategy

Trading successfully is by no means a simple matter. It requires time, market knowledge and market understanding and a large amount of self restraint. ACM does not manage accounts, nor does it give market advice, that is the job of money managers and introducing brokers.

As market professionals, we can however point the novice in the right direction and indicate what are correct trading tactics and considerations and what is total nonsense.

Anyone who says you can consistently make money in foreign exchange markets is being untruthful.

Foreign exchange by nature, is a volatile market. The practice of trading it by way of margin increases that volatility exponentially. We are therefore talking about a very 'fast market' which is naturally inconsistent. Following that precept, it is logical to say that in order to make a successful trade, a trader has to take into account technical and fundamental data and make an informed decision based on his perception of market sentiment and market expectation. Timing a trade correctly is probably the most important variable in trading successfully but invariably there will be times where a traders' timing will be off. Don't expect to generate returns on every trade.

Let's enumerate what a trader needs to do in order to put the best chances for profitable trades on his side:

Trade with money you can afford to lose:

Trading fx markets is speculative and can result in loss, it is also exciting, exhilarating and can be addictive. The more you are 'involved with your money' the harder it is to make a clear-headed decision. Money you have earned is precious, but money you need to survive should never be traded.

What is the market doing? Is it trending upwards, downwards, is it in a trading range. Is the trend strong or weak, did it begin long ago or does it look like a new trend that's forming. Getting a clear picture of the market situation is laying the groundwork for a successful trade

Determine what time frame you're trading on:

Many traders get in the market without thinking when they would like to get out, after all the goal is to make money. This is true but when trading, one must extrapolate in his mind's eye the movement that one expects to happen. Within this extrapolation, resides a price evolution during a certain period of time. Attached to this is the idea of exit price. The importance of this is to mentally put your trade in perspective and although it is clearly impossible to know exactly when you will exit the market, it is important to define from the outset if you'll be 'scalping' (trying to get a few points off the market) trading intra-day, or going longer term

This will also determine what chart period you're looking at. If you trade many times a day, there's no point basing your technical analysis on a daily graph, you'll probably want to analyse 30 minute or hour graphs. Additionally it is important to know the different time periods when various financial centers enter and exit the market as this creates more or less volatility and liquidity and can influence market movements.

Time your trade:

You can be right about a potential market movement but be too early or too late when you enter the trade. Timing considerations are twofold, an expected market figure like CPI, retail sales or a federal reserve decision can consolidate a movement that's already underway. Timing your move means knowing what's expected and taking into account all considerations before trading. Technical analysis can help you identify when and at what price a move may occur. We will look at technical analysis in more detail later.

If in doubt, stay out:

If you're unsure about a trade and find you're hesitating, stay on the sidelines.

Trade logical transaction sizes:

Margin trading allows the fx trader a very large amount of leverage, trading at full margin capacity (in ACM's case 1% or 0.5%) can make for some very large profits or losses on an account. Scaling your trades so that you may re-enter the market or make transactions on other currencies is generally wiser. In short, don't trade amounts that can potentially wipe you out and don't put all your eggs in one basket. ACM offers the same rates regardless of transaction sizes so a customer has nothing to lose by starting small.

Gauge market sentiment:

Market sentiment is what most of the market is perceived to be feeling about the market and therefore what it is doing or will do. This is basically about trend. You may have heard the term 'the trend is your friend', this basically means that if you're in the right direction with a strong trend you will make successful trades. This of course is very simplistic, a trend is capable of reversal at any time. Technical and fundamental data can indicate however if the trend has begun long ago and if it is strong or weak.

Market expectation:

Market expectation relates to what most people are expecting as far as upcoming news is concerned. If people are expecting an interest rate to rise and it does, then there usually will not be much of a movement because the information will already have been 'discounted' by the market, alternatively if the adverse happens, markets will usually react violently.

Use what other traders use:

In a perfect world, every trader would be looking at a 14 day RSI and making trading decisions based on that. If that was the case, when RSI would go under the 30 level, everyone would buy and by consequence the price would rise. Needless to say, the world is not perfect and not all market participants follow the same technical indicators, draw the same trendlines and identify the same support & resistance levels. The great diversity of opinions and techniques used translates directly into price diversity. Traders however have a tendency to use a limited variety of technical tools. The most common are 9 and 14 day RSI, obvious trendlines and support levels, fibonnacci retracement, MACD and 9, 20 & 40 day exponential moving averages. The closer you get to what most traders are looking at, the more precise your estimations will be. The reason for this is simple arithmetic, larger numbers of buyers than sellers at a certain price will move the market up from that price and vice-versa.

by Nicholas H. Bang

Thursday, May 14, 2009

Monday, April 20, 2009

FX - Trading Tips

- Trade pairs, not currencies - Like any relationship, you have to know both sides. Success or failure in forex trading depends upon being right about both currencies and how they impact one another, not just one.

- Knowledge is Power - When starting out trading forex online, it is essential that you understand the basics of this market if you want to make the most of your investments.

The main forex influencer is global news and events. For example, say an ECB statement is released on European interest rates which typically will cause a flurry of activity. Most newcomers react violently to news like this and close their positions and subsequently miss out on some of the best trading opportunities by waiting until the market calms down. The potential in the forex market is in the volatility, not in its tranquility.

- Unambitious trading - Many new traders will place very tight orders in order to take very small profits. This is not a sustainable approach because although you may be profitable in the short run (if you are lucky), you risk losing in the longer term as you have to recover the difference between the bid and the ask price before you can make any profit and this is much more difficult when you make small trades than when you make larger ones.

- Over-cautious trading - Like the trader who tries to take small incremental profits all the time, the trader who places tight stop losses with a retail forex broker is doomed. As we stated above, you have to give your position a fair chance to demonstrate its ability to produce. If you don't place reasonable stop losses that allow your trade to do so, you will always end up undercutting yourself and losing a small piece of your deposit with every trade.

- Independence - If you are new to forex, you will either decide to trade your own money or to have a broker trade it for you. So far, so good. But your risk of losing increases exponentially if you either of these two things:

Interfere with what your broker is doing on your behalf (as his strategy might require a long gestation period);

Seek advice from too many sources - multiple input will only result in multiple losses. Take a position, ride with it and then analyse the outcome - by yourself, for yourself.

- Tiny margins - Margin trading is one of the biggest advantages in trading forex as it allows you to trade amounts far larger than the total of your deposits. However, it can also be dangerous to novice traders as it can appeal to the greed factor that destroys many forex traders. The best guideline is to increase your leverage in line with your experience and success.

- No strategy - The aim of making money is not a trading strategy. A strategy is your map for how you plan to make money. Your strategy details the approach you are going to take, which currencies you are going to trade and how you will manage your risk. Without a strategy, you may become one of the 90% of new traders that lose their money.

- Trading Off-Peak Hours - Professional FX traders, option traders, and hedge funds posses a huge advantage over small retail traders during off-peak hours (between 2200 CET and 1000 CET) as they can hedge their positions and move them around when there is far small trade volume is going through (meaning their risk is smaller). The best advice for trading during off peak hours is simple - don't.

- The only way is up/down - When the market is on its way up, the market is on its way up. When the market is going down, the market is going down. That's it. There are many systems which analyse past trends, but none that can accurately predict the future. But if you acknowledge to yourself that all that is happening at any time is that the market is simply moving, you'll be amazed at how hard it is to blame anyone else.

- Trade on the news - Most of the really big market moves occur around news time. Trading volume is high and the moves are significant; this means there is no better time to trade than when news is released. This is when the big players adjust their positions and prices change resulting in a serious currency flow.

- Exiting Trades - If you place a trade and it's not working out for you, get out. Don't compound your mistake by staying in and hoping for a reversal. If you're in a winning trade, don't talk yourself out of the position because you're bored or want to relieve stress; stress is a natural part of trading; get used to it.

- Don't trade too short-term - If you are aiming to make less than 20 points profit, don't undertake the trade. The spread you are trading on will make the odds against you far too high.

- Don't be smart - The most successful traders I know keep their trading simple. They don't analyse all day or research historical trends and track web logs and their results are excellent.

- Tops and Bottoms - There are no real "bargains" in trading foreign exchange. Trade in the direction the price is going in and you're results will be almost guaranteed to improve.

- Ignoring the technicals- Understanding whether the market is over-extended long or short is a key indicator of price action. Spikes occur in the market when it is moving all one way.

- Emotional Trading - Without that all-important strategy, you're trades essentially are thoughts only and thoughts are emotions and a very poor foundation for trading. When most of us are upset and emotional, we don't tend to make the wisest decisions. Don't let your emotions sway you.

- Confidence - Confidence comes from successful trading. If you lose money early in your trading career it's very difficult to regain it; the trick is not to go off half-cocked; learn the business before you trade. Remember, knowledge is power.

The second and final part of this report clearly and simply details more essential tips on how to avoid the pitfalls and start making more money in your forex trading.

- Take it like a man - If you decide to ride a loss, you are simply displaying stupidity and cowardice. It takes guts to accept your loss and wait for tomorrow to try again. Sticking to a bad position ruins lots of traders - permanently. Try to remember that the market often behaves illogically, so don't get commit to any one trade; it's just a trade. One good trade will not make you a trading success; it's ongoing regular performance over months and years that makes a good trader.

- Focus - Fantasising about possible profits and then "spending" them before you have realised them is no good. Focus on your current position(s) and place reasonable stop losses at the time you do the trade. Then sit back and enjoy the ride - you have no real control from now on, the market will do what it wants to do.

- Don't trust demos - Demo trading often causes new traders to learn bad habits. These bad habits, which can be very dangerous in the long run, come about because you are playing with virtual money. Once you know how your broker's system works, start trading small amounts and only take the risk you can afford to win or lose.

- Stick to the strategy - When you make money on a well thought-out strategic trade, don't go and lose half of it next time on a fancy; stick to your strategy and invest profits on the next trade that matches your long-term goals.

- Trade today - Most successful day traders are highly focused on what's happening in the short-term, not what may happen over the next month. If you're trading with 40 to 60-point stops focus on what's happening today as the market will probably move too quickly to consider the long-term future. However, the long-term trends are not unimportant; they will not always help you though if you're trading intraday.

- The clues are in the details - The bottom line on your account balance doesn't tell the whole story. Consider individual trade details; analyse your losses and the telling losing streaks. Generally, traders that make money without suffering significant daily losses have the best chance of sustaining positive performance in the long term.

- Simulated Results - Be very careful and wary about infamous "black box" systems. These so-called trading signal systems do not often explain exactly how the trade signals they generate are produced. Typically, these systems only show their track record of extraordinary results - historical results. Successfully predicting future trade scenarios is altogether more complex. The high-speed algorithmic capabilities of these systems provide significant retrospective trading systems, not ones which will help you trade effectively in the future.

- Get to know one cross at a time - Each currency pair is unique, and has a unique way of moving in the marketplace. The forces which cause the pair to move up and down are individual to each cross, so study them and learn from your experience and apply your learning to one cross at a time.

- Risk Reward - If you put a 20 point stop and a 50 point profit your chances of winning are probably about 1-3 against you. In fact, given the spread you're trading on, it's more likely to be 1-4. Play the odds the market gives you.

- Trading for Wrong Reasons - Don't trade if you are bored, unsure or reacting on a whim. The reason that you are bored in the first place is probably because there is no trade to make in the first place. If you are unsure, it's probably because you can't see the trade to make, so don't make one.

- Zen Trading- Even when you have taken a position in the markets, you should try and think as you would if you hadn't taken one. This level of detachment is essential if you want to retain your clarity of mind and avoid succumbing to emotional impulses and therefore increasing the likelihood of incurring losses. To achieve this, you need to cultivate a calm and relaxed outlook. Trade in brief periods of no more than a few hours at a time and accept that once the trade has been made, it's out of your hands.

- Determination - Once you have decided to place a trade, stick to it and let it run its course. This means that if your stop loss is close to being triggered, let it trigger. If you move your stop midway through a trade's life, you are more than likely to suffer worse moves against you. Your determination must be show itself when you acknowledge that you got it wrong, so get out.

- Short-term Moving Average Crossovers - This is one of the most dangerous trade scenarios for non professional traders. When the short-term moving average crosses the longer-term moving average it only means that the average price in the short run is equal to the average price in the longer run. This is neither a bullish nor bearish indication, so don't fall into the trap of believing it is one.

- Stochastic - Another dangerous scenario. When it first signals an exhausted condition that's when the big spike in the "exhausted" currency cross tends to occur. My advice is to buy on the first sign of an overbought cross and then sell on the first sign of an oversold one. This approach means that you'll be with the trend and have successfully identified a positive move that still has some way to go. So if percentage K and percentage D are both crossing 80, then buy! (This is the same on sell side, where you sell at 20).

- One cross is all that counts - EURUSD seems to be trading higher, so you buy GBPUSD because it appears not to have moved yet. This is dangerous. Focus on one cross at a time - if EURUSD looks good to you, then just buy EURUSD.

- Wrong Broker - A lot of FOREX brokers are in business only to make money from yours. Read forums, blogs and chats around the net to get an unbiased opinion before you choose your broker.

- Too bullish - Trading statistics show that 90% of most traders will fail at some point. Being too bullish about your trading aptitude can be fatal to your long-term success. You can always learn more about trading the markets, even if you are currently successful in your trades. Stay modest, and keep your eyes open for new ideas and bad habits you might be falling in to.

- Interpret forex news yourself - Learn to read the source documents of forex news and events - don't rely on the interpretations of news media or others.

Wednesday, April 15, 2009

Tuesday, March 31, 2009

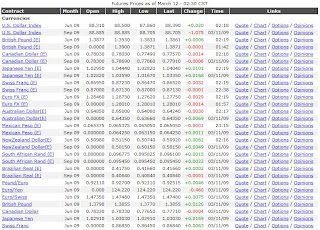

Futures Prices as of March 31-2009

b/c I don't have much time to post all update price today. So, if you are looking for other futures prices please go to

Option Investment Charts and Quotes

Wednesday, March 25, 2009

How To Earn a Fortune By Trading Forex Online

It will also maximize your profit as there is no need for expensive advertising or internet promotion. Nor do you need a huge space such as a store or a warehouse where you will have to pay lease or rent.

Online FOREX trading services are easily available. With some providers offering training ebooks or simulations and some others with specialized software that can teach the patrons, who can then opt for sale and purchase strategy.

To begin your career in FOREX online trading, you would need a bank account with one of the brokers (there are some which offer maintaining balances as small as $300) and then you will be ready to go.

An important thing to remember about online FOREX trading is for you to buy currency when the price is near rock bottom. In a matter of seconds, the prices would rise. This is the time to make a profit, so you sell. Timing and good business intuition is crucial at this part of the trade. If done properly, you can easily earn up 50% or more of your investment!

In trading FOREX online, it is not necessary for you to monitor the movement of your trades all day. You only have to buy your trades and state the prices by which you would want to sell and then forget about it. When the best deal is reached, meaning the prices of your currencies goes up and achieves your selling rate, the system will automatically sell your trades for you.

However, like all speculative trade instruments, while being able to earn for you a lot of money, the potential to lose money is also great as FOREX trading, like all speculative financial instruments rely highly on the movement of the economy, which is volatile. As a FOREX trader, you would want to minimize your risk. So how is that done?

First, it is necessary for you to stay up to date with the economy. Read the news. Know what’s going on inside your country and around the world. Understand the global political and social landscapes.

You will also need to research. An understanding of economics is crucial. You have to understand the rules of demand and supply so you can come up with a knowledgeable decision when you start buying and selling your currencies on the market.

It will also do you good to talk to brokers and professionals in the industry. Observe how they conduct business so you learn from them. Get into FOREX forums on the net where you can get valuable tips that you can apply later on when you start trading.

Lastly, learn to cut your losses. If your portfolio keeps losing week after week, sell them. There is no use hanging on to a losing portfolio as it can only further your losses.

Online FOREX trading is the biggest money generator across all forms of financial instruments available on the investment floor. Although not the first from of trade investment, it has grown in popularity and is now the more common and preferred moneymaking tool.

In fact, FOREX today is bigger than all other markets combined with trades raking in trillions of dollars ever day on the exchange. Unlike futures or stock exchanges, FOREX does not have a trading floor.

It subsists through a network of banks, phones and the internet. Because of its accessibility, it is easy to see why it has grown so much and has not stopped growing over time.

Source: options-university.biz